$ 83.03 in AZ

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SDS150: New Uniden Scanner announcement at SEMA 2025

- Thread starter communicore_

- Start date

Not necessarily. I did order SDS150 last night, and I wasn’t charged with the sales tax. If you live in Texas, you will be charged. If you are outside of TX where Uniden doesn’t have its physical location, then the sales tax should be waived.

I live in Georgia. No physical Uniden locations. Was still charged $76 in sales tax. As I should be. It's the law.

You're thinking pre-Wayfair. Since South Dakota v. Wayfair (2018), states can require an out-of-state seller with no physical location in a state to still collect and remit sales taxes for sales to customers in that state if the seller has 'nexus'. And nexus is no longer determined solely by physical locations. Promptly after Wayfair, Georgia issued Georgia Policy Bulletin SUT-2019-02 which (like many states) requires e-commerce sellers with no physical presence in Georgia to nevertheless collect and remit sales taxes if they do more than $100k/year of sales into the state.

Of course it is not as if the customer can know whether a e-commerce retailer who doesn't charge sales taxes is doing so because they have less than $100k/year in business or because they simply don't comply with tax laws, so I certainly understand people seeking out e-commerce sites that don't assess sales tax on their purchase. However, even before Wayfair, states like Georgia had "collect or report" laws that required their own residents to pay sales taxes on their own purchases where the seller did not collect sales tax on the purchase. So if you live in a sales tax state and you find an online seller that doesn't charge you sales tax, it is generally now your responsibility to calculate and pay the tax yourself or you are the one who doesn't follow tax laws. Not that hardly anyone does that of course.

I live in Kansas and got charged $91.09 for sales tax. But I also, probably like an idiot, added the Ship-safe package protection. Shipping was free though.I live in SC and ordered from Uniden, I was charged $66.50 in sales tax

Dan, you reminded me of when I was stationed in Greenland for a 12-month remote many years ago. The State of Arizona advised me that because AZ was the last state I lived in, . . . I owed them taxes. I was dumbfounded but ordered to pay.

I missed that you quoted two different baseline years.Nope, It's right.. CPI Inflation Calculator / 1985 Radio Shack Catalog

Either way, $950 ain't bad considering the features.

I missed that you quoted two different baseline years.

My favorite is the comparison to the Pro-2006, which for the 'early years' of my scanner hobby was the crème de la crème as far as I was concerned. It cost $399 in the early 90s at Radio Shack, and while I certainly couldn't easily afford it as a teenager, when I finally worked enough to buy one I don't recall ever doubting that it was worth what I'd spent on it.

Here's what's really amazing though. The SDS150 is $949, right? Guess how much you needed in July 1991 to buy what $949 buys today? $399. The SDS150 today is the same price as the Realistic Pro-2006, adjusted for inflation, right down to the dollar!

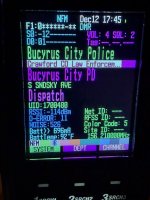

Peg me as one who hopes they don’t add brighter displays to any of the newer models. I keep mine at the lowest possible brightness unless I’m programming something. And that’s already too bright. If they brightened them any more than they are already I’ll have to go third party and rig up some tinted screen guards to place over them to dim them down. They’re already too bright and need them now.

30% on a beta unit without polorozation. Looks damn good!Peg me as one who hopes they don’t add brighter displays to any of the newer models. I keep mine at the lowest possible brightness unless I’m programming something. And that’s already too bright. If they brightened them any more than they are already I’ll have to go third party and rig up some tinted screen guards to place over them to dim them down. They’re already too bright and need them now.

FYI Zip Scanners is now posting on their SDS150 webpage "Now shipping the week of December 15th!" and "Delivery: Tue, Dec 16 to Thu, Dec 18"

They also have this information regarding sales tax posted on their website:

"We collect sales tax on shipments to the following States:

Minnesota

Illinois

Michigan

New York

Ohio

Florida"

They also have this information regarding sales tax posted on their website:

"We collect sales tax on shipments to the following States:

Minnesota

Illinois

Michigan

New York

Ohio

Florida"

- Joined

- Aug 17, 2021

- Messages

- 2

- Reaction score

- 0

Maybe there are other rules based on the state then. Don’t know what to tell you other than look at my attachment.I live in Georgia. No physical Uniden locations. Was still charged $76 in sales tax. As I should be. It's the law.

You're thinking pre-Wayfair. Since South Dakota v. Wayfair (2018), states can require an out-of-state seller with no physical location in a state to still collect and remit sales taxes for sales to customers in that state if the seller has 'nexus'. And nexus is no longer determined solely by physical locations. Promptly after Wayfair, Georgia issued Georgia Policy Bulletin SUT-2019-02 which (like many states) requires e-commerce sellers with no physical presence in Georgia to nevertheless collect and remit sales taxes if they do more than $100k/year of sales into the state.

Of course it is not as if the customer can know whether a e-commerce retailer who doesn't charge sales taxes is doing so because they have less than $100k/year in business or because they simply don't comply with tax laws, so I certainly understand people seeking out e-commerce sites that don't assess sales tax on their purchase. However, even before Wayfair, states like Georgia had "collect or report" laws that required their own residents to pay sales taxes on their own purchases where the seller did not collect sales tax on the purchase. So if you live in a sales tax state and you find an online seller that doesn't charge you sales tax, it is generally now your responsibility to calculate and pay the tax yourself or you are the one who doesn't follow tax laws. Not that hardly anyone does that of course.

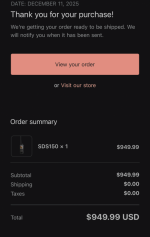

Ordered mine last night. Will be delivered to my house on Monday. Look at these two attached files. One is my actual order and the other one the order I tried to place just now for testing. Same thing. No sales tax.I live in SC and ordered from Uniden, I was charged $66.50 in sales tax

Attachments

That’s very workable for 30%.

Those colors!! We’ve come a long way from the eye piercing 436/536 staring into the sun white backgrounds. Now I just need to get those couple slots in the menu for my custom RGB/HEX colors. I can dream. 😂